Fascination About Medigap

Wiki Article

Unknown Facts About How Does Medigap Works

Table of ContentsWhat Is Medigap Can Be Fun For EveryoneThe smart Trick of How Does Medigap Works That Nobody is Talking AboutThe smart Trick of How Does Medigap Works That Nobody is DiscussingHow What Is Medigap can Save You Time, Stress, and Money.The Only Guide to Medigap

You will require to talk with an accredited Medicare representative for pricing as well as schedule. It is extremely advised that you purchase a Medigap plan throughout your six-month Medigap open enrollment period which begins the month you turn 65 and are registered in Medicare Part B (Medical Insurance) - medigap. During that time, you can acquire any kind of Medigap policy offered in your state, even if you have pre-existing conditions.You may have to acquire a more pricey plan later, or you might not have the ability to buy a Medigap policy in all. There is no warranty an insurer will certainly sell you Medigap if you obtain insurance coverage outside your open enrollment duration. Once you have actually chosen which Medigap plan fulfills your needs, it's time to figure out which insurance provider market Medigap plans in your state.

The exact protections depend on the type of plan that is purchased and which mention you live in.

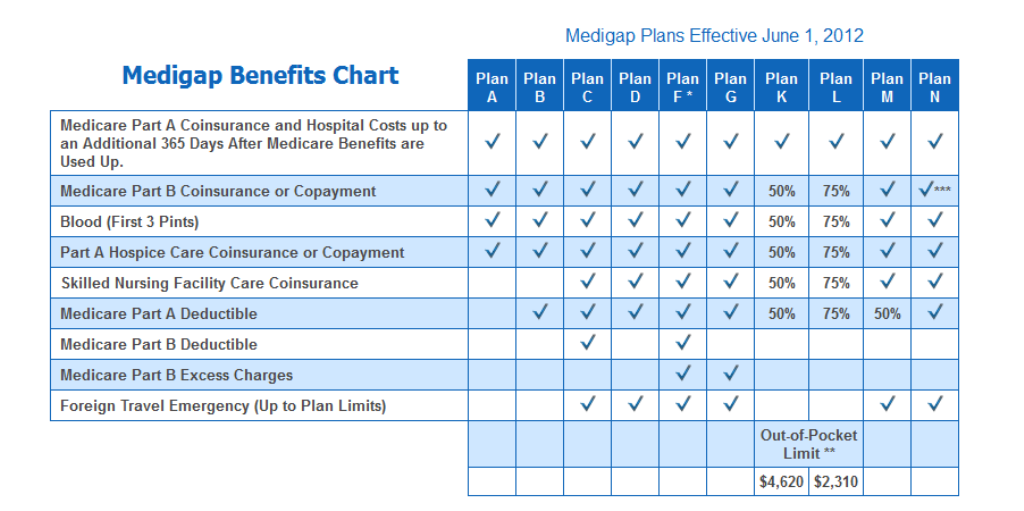

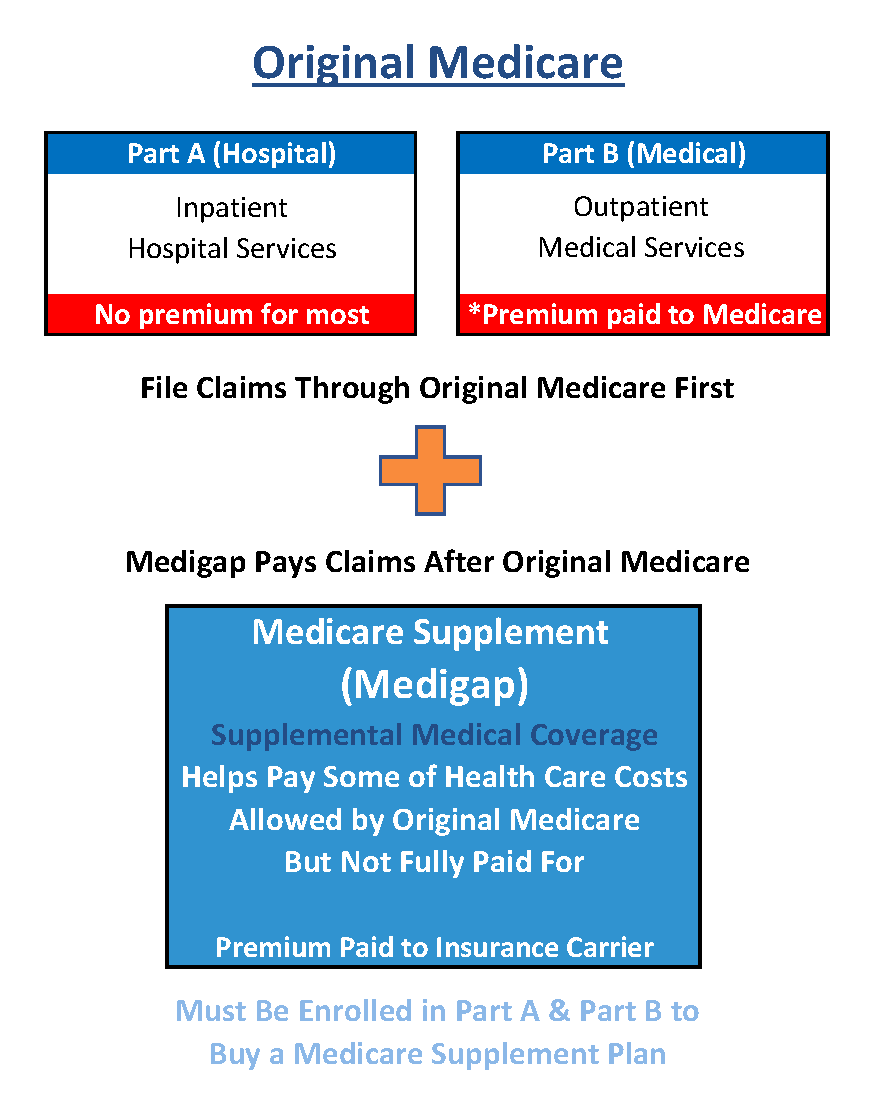

As a whole, Medigap insurers work with Original Medicare and each plan type offers the same benefits, also across insurance providers. In many states, Medicare supplement strategies are named A with N. Table of Contents, Expand, Collapse When checking out Medigap plans, you might additionally read concerning Medicare Benefit prepares Called Medicare Part C.

Medicare supplement insurance, on the other hand, is an addition to your existing Original Medicare plan. Remember that Medigap plans just can be combined with Initial Medicare and not Medicare Benefit. Medigap policies are standard and determined by letters, and also need to adhere to government and also state guidelines. Typical Medigap insurance coverages consist of: This is an out-of-pocket cost that people have to pay each time they receive healthcare or a clinical item, such as a prescription.

This is the percent of the expense of a service that you show Medicare. medigap. With Part B, Medicare typically pays 80% and also the person pays 20%. This is the quantity of cash the individual need to pay out of pocket for medical care prior to Medicare begins paying for the expenses. With Component A, there's an insurance deductible that applies to each advantage period for inpatient care in a health center setup.

What Does How Does Medigap Works Mean?

If you need health care services while taking a trip exterior of the United States, it is necessary to understand that Initial Medicare does not cover emergency situation healthcare solutions or supplies outside of the united state However, there are some points that Medicare supplement insurance usually does not cover, such as vision or oral treatment, eyeglasses, hearing help, private-duty nursing, or long-lasting care.

Medigap plans can help you minimize your out-of-pocket healthcare expenses so you can obtain affordable treatment for detailed healthcare during your retired life years. Medicare supplement strategies may not be right for each scenario, yet recognizing your options will certainly aid you decide whether this kind of protection could help you handle medical care prices.

Journalist Philip Moeller is right here to give the responses you need on aging as well as retired life. His once a week column, "Ask Phil," intends to assist older Americans and their families by addressing their health and wellness care and financial questions.

Facts About Medigap Revealed

The largest gap is that Part B of Medicare pays just 80 percent of protected expenses. Most likely, more people would certainly buy Medigap plans if they can afford the monthly premiums. Nearly two-thirds of Medicare enrollees have standard Medicare, with regarding 35 percent of enrollees rather picking Medicare Benefit plans.

Unlike various other exclusive Medicare insurance policy plans, Medigap strategies are regulated by the states. And while the particular coverage in the 11 different sorts of strategies are dictated by government regulations, the costs and schedule of the strategies rely on state regulations. Federal regulations do offer guaranteed issue legal rights for Medigap buyers when they are brand-new to Medicare as well as in some circumstances when they switch over in between Medicare Benefit as well as fundamental Medicare.

However, once the six-month period of federally mandated legal rights has actually passed, state policies take over determining the civil liberties individuals have if they desire to get brand-new Medigap strategies. Right here, the Kaiser table of state-by-state rules is important. It ought to be a compulsory quit for anyone thinking of the function of Medigap in their Medicare strategies.

Medigap - Truths

I have not seen tough information on such conversion experiences, as well as consistently inform viewers to evaluate the marketplace for brand-new plans in their state before they switch over into or out of a Medigap strategy throughout open registration. I think that anxiety of a possible problem makes many Medigap insurance policy holders immune to transform.A Medicare Select plan is a Medicare Supplement plan (Strategy A via N) that conditions the payment of benefits, Medigap benefits in whole or in part, on using network suppliers. Network carriers are service providers of health and wellness treatment which have actually entered right into a created agreement with an insurance company to offer benefits under a Medicare Select policy.

Report this wiki page